Question 3 on the G-Research Sample Quant Exam:

A stock has beta of

and stock specific daily volatility of

. Suppose that yesterday’s closing price was

and today the market goes up by

- What’s the probability of today’s closing price being at least

?

- What’s the probability that the closing price is at least

?

Generally, stock returns are modeled using a normal distribution. This is because the Central Limit Theorem says that the sum of many small, independent random variables tends to be normally distributed. As a result, daily stock price movements, influenced by a variety of small, independent factors, thus follow a normal distribution. (Stock prices, on the other hand, follow a log-normal distribution – but this is another topic.)

Let ![]() denote a random variable representing the stock’s returns. Then

denote a random variable representing the stock’s returns. Then

![]()

We already know that ![]() . To calculate

. To calculate ![]() , note that the beta,

, note that the beta, ![]() , represents the stock’s sensitivity to the market (note that

, represents the stock’s sensitivity to the market (note that ![]() can be negative in some cases). Hence, we just use the formula

can be negative in some cases). Hence, we just use the formula

![]()

For a stock’s current price to reach a target price, it needs a return of

![]()

Now we can calculate the probability. It is given by

![]()

![]()

![]()

In the general case, given a stock’s currence price (![]() ), target price (

), target price (![]() ), beta (

), beta (![]() , idiosyncratic volatility (

, idiosyncratic volatility (![]() ), and the market’s expected return (

), and the market’s expected return (![]() ), we can compute the probability that the stock hits the target price (if

), we can compute the probability that the stock hits the target price (if ![]() ) or drops below it (if

) or drops below it (if ![]() ).

).

First define ![]() and

and ![]() . Then

. Then

![]()

![]()

Using our new formulas, the probability that the stock in the original problem statement exceeds the price of ![]() per share is

per share is

![]()

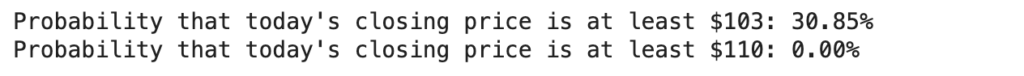

We can actually code this using Python.

import numpy as np

import scipy.stats as stats

# Given data

beta = 2.0 # Stock's sensitivity to the market

market_return = 0.01 # Market's expected return

sigma = 0.02 # Idiosyncratic volatility

p_c = 100 # Current price

mu = beta * market_return # Stock's expected return

# 103 case:

p_t_103 = 103 # Target prices (p_t)

x_103 = (p_t_103 / p_c) - 1 # Required returns (x)

p_at_least_103 = 1 - stats.norm.cdf(x_103, mu, sigma) # P(R > x) - use a built in CDF function

print(f"Probability that today's closing price is at least 103: {p_at_least_103:.2%}") # Print odds

# 110 case:

p_t_110 = 110 # Target prices (p_t)

x_110 = (p_t_110 / p_c) - 1 # Required returns (x)

p_at_least_110 = 1 - stats.norm.cdf(x_110, mu, sigma) # P(R > x) - use a built in CDF function

print(f"Probability that today's closing price is at least 110: {p_at_least_110:.2%}") # Print odds

This is a good check that our work makes sense. However, it starts to become very interesting when we generalize all of this.

Below is a function that takes a stock and a target price (and optionally the market index) as inputs and calculates the probability that the stock hits the target price.

import yfinance as yf

import numpy as np

import scipy.stats as stats

from datetime import datetime, timedelta

import statsmodels.api as sm

def stock_price_probability_calculator(stock, target_price, market = "^GSPC"):

'''Takes in a stock symbol (str), a target price (float), and market symbol (str) that is preset to the S&P500'''

def returns(ticker): # Enter a valid stock symbol

start_date = datetime.now() - timedelta(days=90) # Can change this to see a different range

end_date = datetime.now()

data = yf.download(tickers=ticker, start=start_date, end=end_date, interval='1d')

returns = data['Adj Close'].pct_change().dropna()

return returns

stock_returns = returns(stock)

market_returns = returns(market)

def beta(stock_returns, market_returns):

covariance_matrix = np.cov(stock_returns, market_returns)

beta = covariance_matrix[0, 1] / covariance_matrix[1, 1]

return beta

beta = beta(stock_returns, market_returns)

# Calculate idiosyncratic volatility by regressing stock returns on market returns

def idiosyncratic_volatility(stock_returns, market_returns):

X = sm.add_constant(market_returns)

model = sm.OLS(stock_returns, X).fit()

residuals = model.resid

idiosyncratic_volatility = residuals.std()

return idiosyncratic_volatility

idiosyncratic_volatility = idiosyncratic_volatility(stock_returns, market_returns)

# Last price and day of stock and market

live_stock_data = yf.download(tickers=stock, period='1d', interval='1m')

live_market_data = yf.download(tickers=market, period='1d', interval='1m')

latest_stock_price = live_stock_data['Adj Close'].iloc[-1]

latest_stock_date = live_stock_data.index[-1]

latest_market_price = live_market_data['Adj Close'].iloc[-1]

latest_market_date = live_market_data.index[-1]

avg_market_return = market_returns.mean()

mu = beta * avg_market_return

sigma = idiosyncratic_volatility

x = (target_price / latest_stock_price) - 1 # Stock return needed to reach target price

if target_price > latest_stock_price:

probability = 1 - stats.norm.cdf(x, mu, sigma)

else:

probability = stats.norm.cdf(x, mu, sigma)

print("\n[Data Retrieval Complete]\n")

print(f"Latest Price of {stock}: {latest_stock_price:.2f} at {latest_stock_date.now()}")

print(f"Latest Price of {market}: {latest_market_price:.2f} at {latest_market_date.now()}")

print(f"Beta of {stock}: {beta:.2f}")

print(f"Idiosyncratic Volatility of {stock}: {idiosyncratic_volatility:.2%}")

print(f"Average Market Return: {avg_market_return:.2%}")

if target_price > latest_stock_price:

print(f"Probability that {stock} will close at least at {target_price}: {probability:.2%}\n")

else:

print(f"Probability that {stock} will close under {target_price}: {probability:.2%}\n")

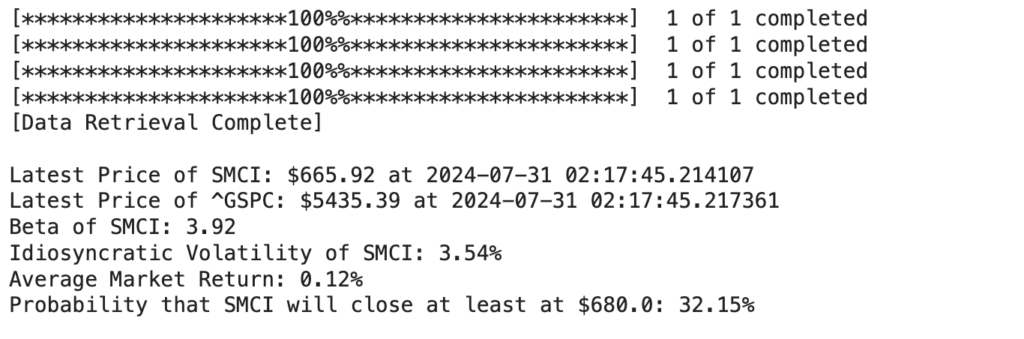

stock_price_probability_calculator("SMCI", 680.00) # Example

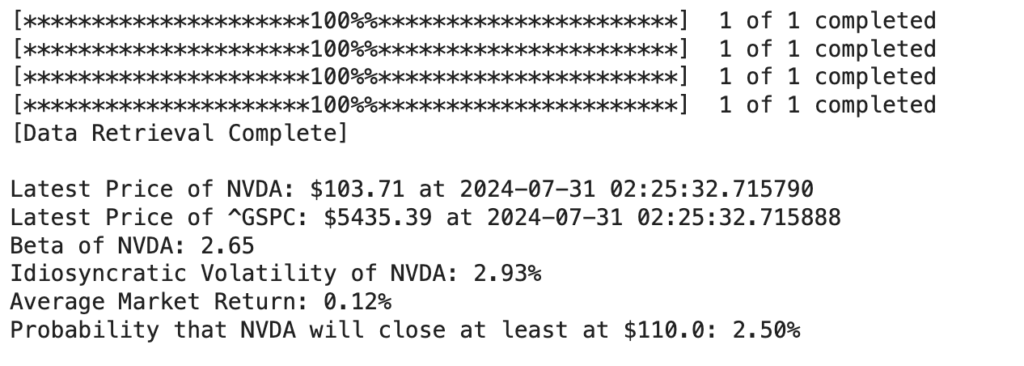

For example, Nvidia (NVDA) close at ![]() per share today (July 30, 2024). What is the probability that it closes at

per share today (July 30, 2024). What is the probability that it closes at ![]() per share tomorrow?

per share tomorrow?

stock_price_probability_calculator("NVDA", 110.00)

Disclaimer: This is not investment advice. 🙂

GitHub repository: https://github.com/trippytrung/Stock-Price-Probability-Calculator